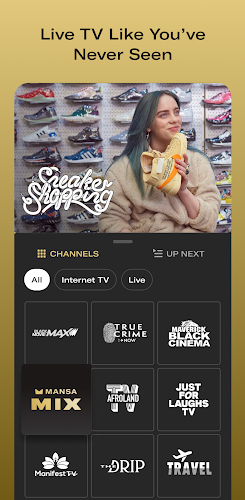

Mansa is an innovative platform designed to simplify financial management, helping individuals and businesses track, manage, and optimize their finances with ease. Offering a wide range of tools and services, Mansa empowers users to make smarter financial decisions, track expenses, manage budgets, and invest efficiently. With its intuitive interface, personalized recommendations, and seamless integration with banking and financial services, Mansa provides everything you need to take control of your financial future. Whether you're looking to save, invest, or simply get a better grasp of your spending habits, Mansa is your trusted financial companion.

Features of Mansa:

- Expense Tracking: Mansa allows users to easily track their daily expenses, categorize spending, and monitor trends over time to improve financial awareness.

- Budgeting Tools: The platform offers powerful budgeting tools that let you set goals, allocate funds to various categories, and stay within your financial limits.

- Investment Insights: Mansa provides personalized investment recommendations based on your financial profile, helping you grow your wealth with the right strategies.

- Bank Integration: The platform securely connects with your bank accounts, credit cards, and other financial services to provide a unified view of your financial health in real-time.

- Real-Time Notifications: Get instant alerts about upcoming bills, account balances, and unusual transactions, helping you stay on top of your finances and avoid surprises.

Tips for Using Mansa:

- Set Financial Goals: Use Mansa’s goal-setting features to plan for short- and long-term objectives, such as saving for a vacation, buying a home, or preparing for retirement.

- Monitor Spending Habits: Regularly check your expense tracker to identify any areas where you can cut back, and adjust your budget accordingly for better savings.

- Take Advantage of Investment Advice: Explore Mansa’s investment tools to receive tailored recommendations based on your risk tolerance and financial goals.

- Link All Financial Accounts: To get the most out of Mansa, ensure that all your bank accounts, credit cards, and payment apps are linked to the platform for an accurate financial overview.

- Review Monthly Reports: At the end of each month, review your financial reports to evaluate your spending, savings, and investment performance to stay on track with your goals.

Conclusion:

Mansa is an all-in-one financial management tool that offers a comprehensive set of features to help you gain control over your money. With its intuitive interface, expense tracking, budgeting tools, and investment guidance, it makes managing personal or business finances simpler and more efficient. Whether you’re looking to track spending, set savings goals, or optimize your investments, Mansa provides the resources and insights you need to achieve financial success. Start using Mansa today and take the first step toward better financial health and smarter decision-making.