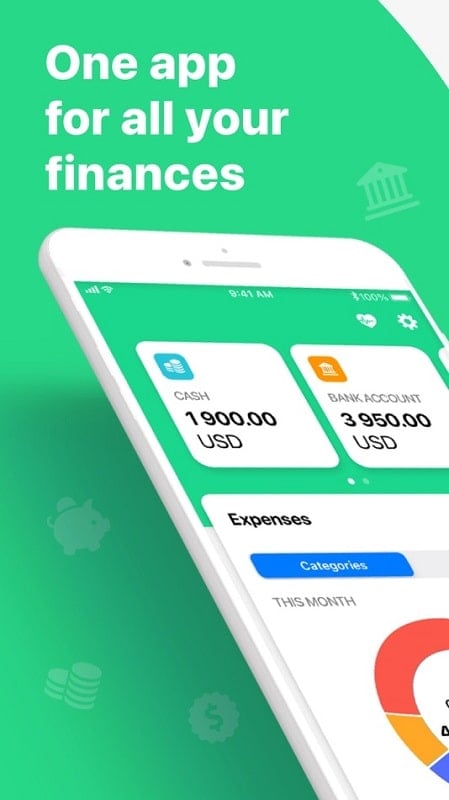

Wallet is a secure and convenient app designed to help you manage your finances, track your spending, and organize your digital payments all in one place. Whether you want to store your credit cards, loyalty cards, or keep track of your daily expenses, Wallet provides a streamlined and user-friendly platform to help you stay on top of your financial life. With advanced security features like encryption and password protection, Wallet ensures that your sensitive information is safe, while offering the flexibility to quickly access and use your digital wallet when needed.

Features of Wallet:

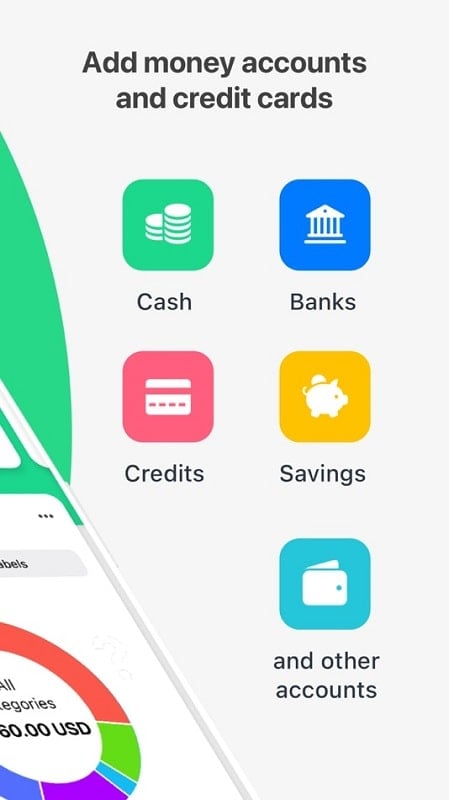

1. Secure Digital Payments: Store your credit cards, debit cards, and loyalty cards securely in one place for easy access and digital payments, eliminating the need for physical cards.

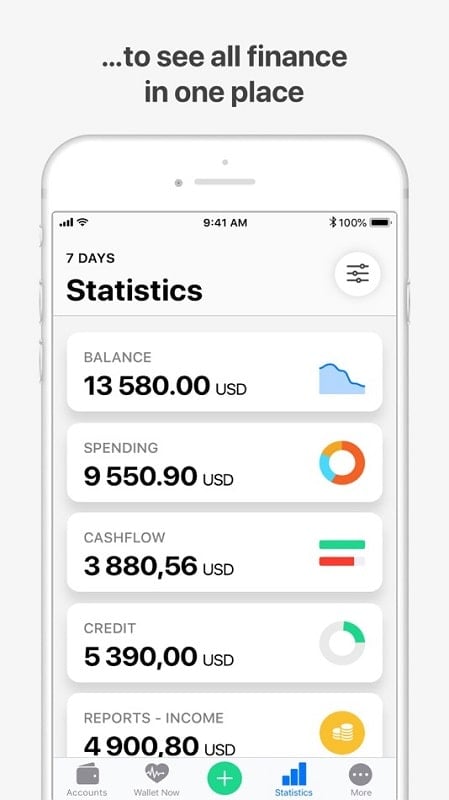

2. Expense Tracking: Categorize your expenses and track your spending habits over time. Wallet helps you visualize where your money goes, giving you insights into your financial behavior.

3. Budgeting Tools: Set up personalized budgets for different categories, helping you stay within your financial limits. Wallet provides real-time tracking to ensure you stick to your goals.

4. Transaction History: View your detailed transaction history, complete with date, category, and amount, so you can easily review your purchases and keep track of past payments.

5. Bill Reminders: Set reminders for upcoming bills or payments, ensuring you never miss a due date. Wallet helps you stay organized and avoid late fees.

6. Advanced Security Features: Protect your wallet with a secure PIN, biometric authentication, or password, ensuring that only you have access to your financial data.

Playing Tips of Wallet:

1. Categorize Expenses: Regularly categorize your transactions to maintain a clear overview of your spending. This will help you spot patterns and make adjustments to stay on track with your budget.

2. Set Realistic Budgets: When creating a budget, start with realistic amounts based on your previous spending habits. Adjust as needed to make sure your budget is achievable without causing stress.

3. Use Notifications for Bills: Enable bill reminders and notifications for upcoming payments so that you are always prepared and avoid missing payment deadlines.

4. Regularly Review Your Spending: Make it a habit to review your spending on a weekly or monthly basis. Use Wallet’s transaction history to check if you're sticking to your budget or if there are areas where you can cut back.

5. Link Multiple Accounts: If you manage multiple accounts (e.g., checking, savings, and credit cards), link them all to Wallet for a comprehensive view of your financial situation.

6. Enable Security Features: Always activate two-factor authentication, a PIN, or biometric features to protect your wallet. This ensures that even if your phone is lost or stolen, your financial data remains safe.

Conclusion:

Wallet is an all-in-one digital finance manager that offers seamless integration for secure payments, budgeting, and expense tracking. With its intuitive design, customizable features, and top-notch security, it provides users with a smart way to manage their finances on the go. Whether you're aiming to improve your spending habits, stay on top of your bills, or streamline your payment methods, Wallet is a practical and reliable tool for anyone looking to take control of their financial life. Its simplicity and functionality make it a must-have app for managing personal finances in today's fast-paced world.